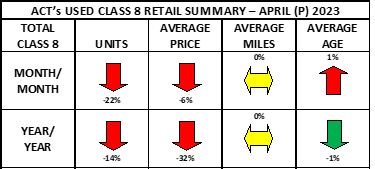

Used Truck Same Dealer Retail Sales Shrank 22% M/M in April

ACT Research reports the preliminary Class 8 same dealer used truck retail sales volume balloon deflated in April

The preliminary Class 8 same dealer used truck retail sales volume balloon deflated in April, shrinking 22% m/m. The decline split the difference with the auction and wholesale markets. As expected, auction activity pulled back (-45%) from March’s quarter-end spike. On the flip side, wholesale deals were up 130% m/m.

Combined, the used truck industry saw preliminary same dealer sales pull back 27% m/m, according to the latest preliminary release of the State of the Industry: U.S. Classes 3-8 Used Trucks published by ACT Research.

Compared to March 2023, average retail price declined 6%. Miles was flat and age increased 1%. Compared to April of 2022, volumes, price, and age declined, and miles was flat.

According to Steve Tam, Vice President at ACT Research, “Historically, April is a pretty average month, slowing 8-10% from March.” He continued, “Clearly, some used truck buyers are beginning to react to the increased pressure of slowing freight and economic uncertainty.”

He added, “The preliminary average retail price (same dealer sales) of used Class 8 trucks sold in April fell 6.0% m/m, to $68,500, 32% below the industry peak in April 2022.”

Tam concluded, “While easier comparisons from this point forward might make it feel like the pricing environment is improving, prices will still be falling sequentially, counteracting increasing optimism.”

Category: Equipment, Featured, General Update, News, Shop Stuff, Vehicles