Work Truck Solutions’ Third Quarter Data Reveals Healthy Comeback For New Commercial Vehicles

Data reveals a growing demand for new work trucks and vans, with average prices reaching record highs

Work Truck Solutions® released their Q3, 2023 Commercial Vehicle Market Analysis. Data reveals a growing demand for new work trucks and vans, with average prices reaching record highs. Meanwhile, used work trucks and vans continue to show higher average mileage when compared to all but one quarter of 2022.

New Commercial Vehicles

- Average vehicle prices increased 5.5% QoQ and 8.2% YoY.

- On-lot vehicle inventory per dealer continues to grow, up 12.4% QoQ and a staggering +78.6% YoY.

- Average Days to Turn (DTT) showed a slight increase QoQ of 1.9% and an incredibly high YoY jump of 46.0%.

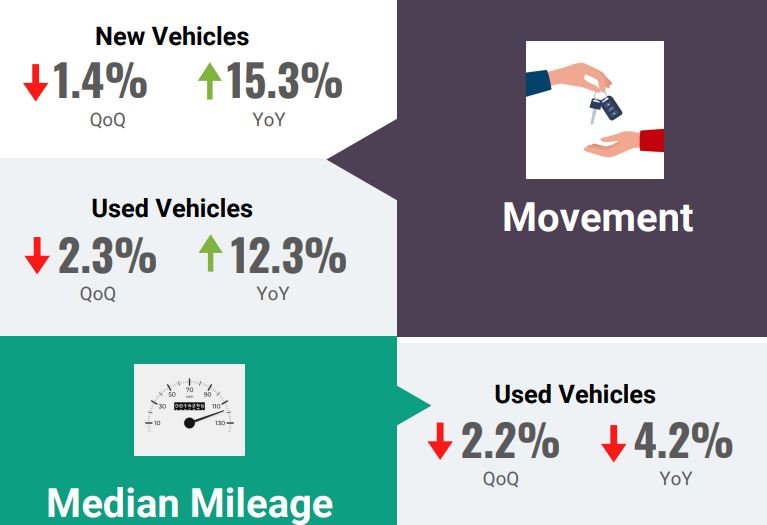

- Vehicle movement, or sales, showed a slight dip QoQ, coinciding with the DTT increase, with a 1.4% QoQ drop, but was still up 15.3% YoY. Considering the large influx of on-lot inventory in Q1, and the corresponding jump in sales in Q2, it’s no surprise to see a tempering of sales in Q3 as some of the pent-up demand is being satisfied.

- Searches for new work trucks and vans increased slightly QoQ, up 1.1%, and still show increases YoY. These bumps are partially due to the rise in new on-lot inventory as we’ve reported over the last several quarters, which has given rise to website shoppers having more confidence that they can acquire vehicles right away, rather than having to order them. However, many commercial vehicle buyers are also recognizing the need to exercise more foresight when considering their work truck needs, understanding that the pre-order process may be here to stay.

Used Commercial Vehicles

- Average vehicle prices increased 1.6% QoQ and decreased 1.0% YoY.

- On-lot vehicle inventory per dealer fell 5.25% QoQ, but remained practically unchanged YoY with a 0.3% increase.

- Average DTT showed a dip of 3.9% QoQ following the large 9.0% drop from Q1 2023 to Q2 2023.

- Vehicle movement, or sales, numbers cooled off this quarter, with average moved used work trucks/vans per dealer decreasing 2.3% QoQ, but still up 12.3% YoY.

- Median mileage of used work trucks and vans remains elevated overall, with only marginal impacts on prices. Mileage slipped slightly QoQ, down 2.2%, and shows a 4.2% decrease YoY, possibly indicating a new trend in used vehicle age as older inventory finally moves off dealership lots. Availability of new vehicles impacts average used vehicle mileage as businesses are able to replace fleet vehicles before they accrue too many miles.

Notably, even as some manufacturing recovery from pandemic related downturns occurs, other issues, such as labor strikes, can still have a significant impact on used vehicle mileage and price.

“As we analyze the market for work trucks and vans, the data indicates continued strong interest in new vehicles, even as the average price for them has hit a record high of $57,290,” says Aaron Johnson, CEO of Work Truck Solutions. “These insights signal a potential shift towards newer commercial vehicles—especially a desire for medium-duty—requiring strategic adjustments to inventory and a careful watch on these trends, including the upfit configurations that are critically important to buyers in your market. Having the tools to ride these waves is what will set some dealers apart from those that try to return to ‘business as usual’.”

Category: Cab, Trailer & Body, Cab, Trailer & Body New, Equipment, Featured, General Update, News, Products, Vehicles