Freight rates showed continued stabilization in December

Total spending on freight fell 3.0% m/m, against a decline in shipments of 1.6% m/m

Freight rates showed continued stabilization in December in both our Inferred Freight Rates series and the Cass Truckload Linehaul Index. Truckload linehaul rates were in line with August, and inferred rates were in line with September.

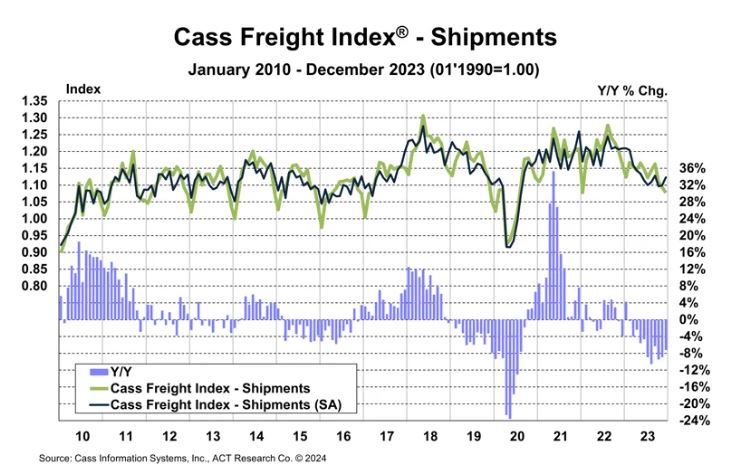

- Total spending on freight fell 3.0% m/m, against a decline in shipments of 1.6% m/m.

- The relative changes in these indexes tell us that rates (all-in costs) were down 1.5% m/m.

- While down nominally, shipping volumes as compared to normal seasonality were up 2.1% m/m.

Freight Expectations

Global ocean shipping disruptions will likely add to air and land freight movements in 2024. The two primary routes from Asia to the U.S. East Coast have been snarled by conflict in the Red Sea and low water in the Panama Canal, which is essentially a perfect storm restricting access to the U.S. East Coast. We think the West coast ports and intermodal network will continue to experience elevated demand as a result.

Destocking and declining goods consumption have been key features of the freight recession, but both cycle drivers seem to be starting to reverse course. Real retail sales recently turned positive after a year of declines, and after 18 months of destocking, a restock is drawing near, likely spurred by ocean risks.

The acceleration in real disposable incomes, supported by a surprisingly sharp disinflation, and the ongoing strong labor market suggest freight demand fundamentals will improve in 2024. While helped by easy comparisons, recent railroad trends suggest the next phase of the cycle could be coming around the bend.

Category: Equipment, Featured, General Update, News, Vehicles