2023 Freight Expectations

Cass Freight Index reports trajectory of freight markets in 2023, and the cycle is likely to enter yet another phase later in 2023

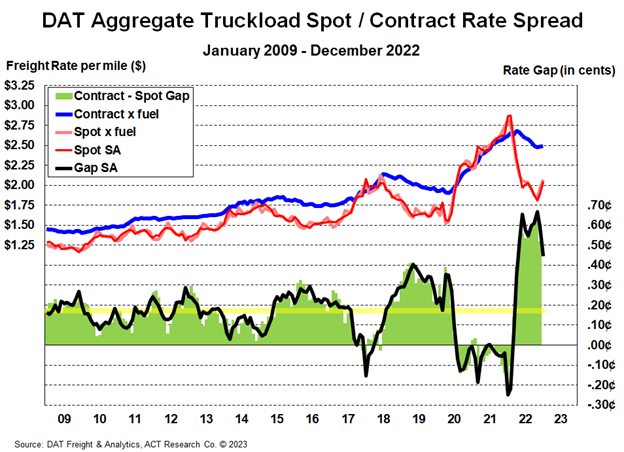

As we enter 2023, we see the truckload market transitioning from the late-cycle stage to the bottoming stage. Some of the recent rise in spot rates, ex-fuel, is due to seasonality, as rates surged toward the end of peak season, and some of it is the 70¢ per gallon drop in diesel prices in the past two months. Those gains tend to be competed away in loose markets like 2022 within a few weeks but have held so far.

After a long downtrend in 2022, the recent bounce in spot rates and tightening in the spot/contract spread suggest a bottoming truckload rate cycle. This should turn the trajectory of freight markets in 2023, and the cycle is likely to enter yet another phase later in 2023.

One exciting feature of the new freight data partnership between ACT Research and DAT Freight & Analytics is that it helps us (ACT Research) elaborate on the truckload rate environment. In particular, we think the difference between spot and contract rates, or the spread, is very instructive for the near-term direction of contract rates in particular.

From the large spread, there is downward pressure on contract rates, which has been the case for much of the past year. But we also see the recent tightening of that spread as a key signpost of this new stage of the cycle, even green shoots of a new rate cycle.

For more on why this is happening and what it means for the future of freight markets, the ACT Research Freight Forecast provides analysis and forecasts for a broad range of U.S. freight measures, including the Cass Freight Index, Cass Truckload Linehaul Index, and DAT spot and contract rates by trailer type.

Category: Equipment, Featured, General Update, News