Driving the Future Forward: Pandemic Shifts Consumer Mindset on Tech Adoption

Deloitte reports on Automotive industry navigates pandemic speedbumps as consumers take detour towards traditional platforms

While the long-term trend towards electric vehicles (EVs) continues to solidify, consumer anxiety amid the pandemic may be shifting automotive priorities towards familiarity and affordability, with 74% of U.S. consumers looking for a traditional internal combustion engine in their next vehicle.

Vehicle payment deferments are also raising some concern across the globe with younger consumers in the U.S. more than two times more likely to push back payments (23% of 18-34 year olds versus 10% of the overall study sample).

While online automotive sales have risen in popularity globally due to the pandemic, 71% of U.S. consumers still want the in-person experience moving forward.

Why this matters

Uncertainty and financial concerns driven by COVID-19 continue to have an impact on consumer mobility and the global automotive sector. For more than a decade, Deloitte has been exploring automotive consumer behaviors and trends impacting the global automotive ecosystem. This year’s report titled, “2021 Global Automotive Consumer Study,” surveyed more than 24,000 consumers from 23 countries. It explores opinions regarding a variety of issues impacting the global automotive sector, including implications of the pandemic on consumer perceptions, the development of advanced technologies and impact of digital automotive retail platforms.

Recharging consumer interest in EVs

Before the transportation torch is officially passed from internal combustion engines (ICE) to electric powertrains, consumers require greater assurance around mileage, robust charging infrastructure rollouts and affordability of the electric segment. While the pandemic continues to play a large role in exacerbating this apprehension, stricter carbon emission regulations on the horizon point to a “closing window” for the traditional ICE segment experience.

- Motivated by a sense of familiarity and financial concerns due to COVID-19, consumers across the globe are showing a near-term reluctance to switching away from ICE technology. Just one-quarter (26%) of U.S. consumers are considering alternative engine solutions for their next vehicle, down 15% year-over-year.

- The top concern about EVs in both the U.S. and Germany is battery range (28%), whereas lack of charging infrastructure is top of mind in Asia (The Republic of Korea at 32%, Japan at 29% and India at 26%).

- While the majority of consumers in the U.S. (71%), Japan (71%), Germany (64%) and India (63%) expect to charge their vehicles at home, more than half (51%) of respondents in China intended to make use of available charging stations at their place of work or on the street instead.

- Consumer perception of connected vehicles appears to be edging up in Asia, with as many as 83% of consumers in China finding the technology beneficial; that number is just about half in the U.S. (44%).

- With increased connectivity, 64% of U.S. consumers are most concerned about the possibility of hacking, which is shared among consumers in Germany (64%), The Republic of Korea (64%) and India (66%).

- Advanced vehicle features that promote greater safety capabilities, such as blind-spot detection, are most appealing to U.S consumers (70%), whereas Germany also ranks built-in navigation systems as their most important future vehicle option at 65%. But, cost continues to be a limiting factor for advanced vehicle technologies with 74% of U.S. consumers unwilling to pay more than US$500 for infotainment.

Key Quote

“The global automotive industry, like many others, has been profoundly impacted by the pandemic. That said, the momentum toward a more connected vehicle future remains bright and full of promise. Ever stricter vehicle emissions requirements in many markets around the world are also pushing the goal of electric mobility forward. Efforts to realize these technologies will open up a new world of possibility.”

– Dr. Harald Proff, Deloitte Global automotive leader and partner, Deloitte Germany

Financial concerns reroute future vehicle intentions

Continued financial concerns are affecting vehicle ownership across the globe. Due to the COVID-19 pandemic, consumers in many markets are rethinking not only when they will be buying their next vehicle but also what type of vehicle they will buy next. As the risk of affordability concerns increase, a growing number of people are deferring vehicle loan/lease payments with some intending to acquire a less expensive vehicle than originally planned.

- One in 10 Americans (10%) opted to defer their automotive payment in 2020, but that rises to 23% among consumers aged 18-34.

- While the vast majority (84%) of U.S. consumers plan on purchasing a similar vehicle in the future, more than half of consumers in India (57%) plan to enter a completely different vehicle segment as a result of the pandemic.

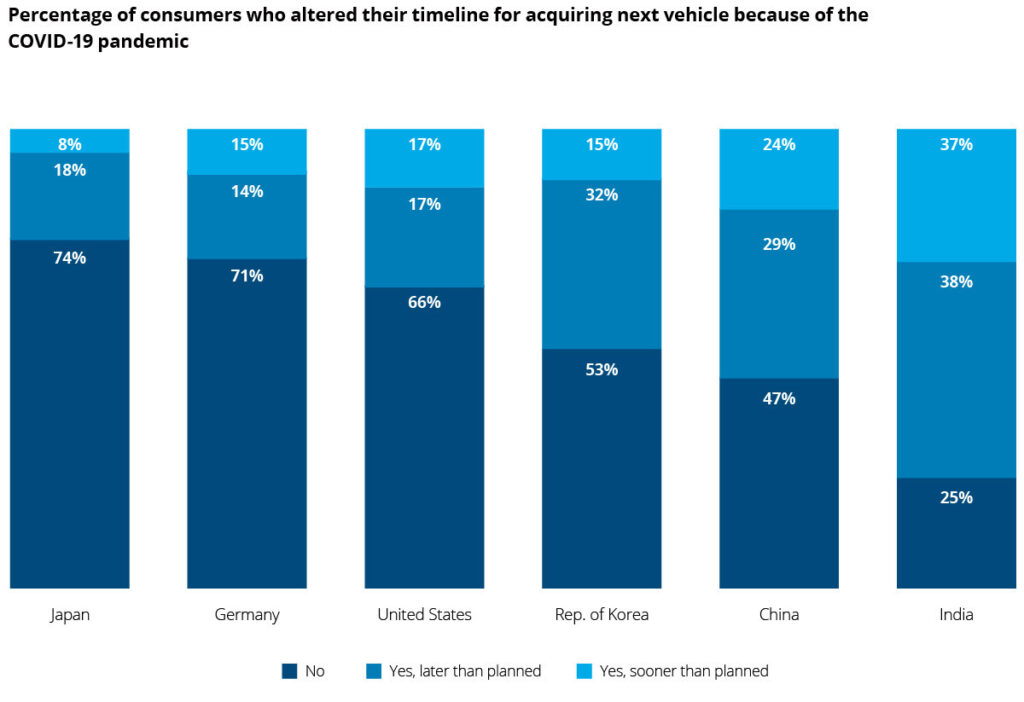

- Timelines for acquiring their next vehicle varies greatly, with 66% of U.S. consumers remaining on initial timelines. In contrast, roughly one-third of consumers in India (38%) and The Republic of Korea (32%) plan on delaying their next vehicle purchase.

Mapping future digital auto services

The COVID-19 pandemic has given rise to more virtual transactions, but certain aspects of the buying process remain difficult to digitize, reinforcing the consumers’ desire for an in-person experience.

- U.S. preferences remain largely in favor of in-person sales experiences (71%). In contrast, consumers in India look to be the most open to a virtual transaction in the automotive space with almost one-third (27%) indicating a fully virtual buying experience is preferred.

- Authorized dealers will remain a part of the virtual buying process with more than half (59%) of U.S. consumers preferring to interact with a franchised seller.

- Having the ability to see the car in-person remains a major deterrent for fully virtual sales noted by 75% of U.S. consumers, in addition to respondents in Japan (80%) and Germany (76%). Similarly, more than half (59%) of consumers in China listed the physical test drive of a vehicle as a deterrent to a fully virtual transaction, as did 64% of U.S. respondents.

- One virtual transaction that engenders a high level of interest globally is “virtual servicing,” where a vehicle is picked up from a home or office when it needs service. Consumers in the U.S. (46%), The Republic of Korea (70%), and Japan (67%) are largely in favor of the added convenience, provided it comes free of charge.

Key quote

“Unlike many other retail sectors that have seen a wholesale shift to online buying, purchasing a vehicle remains a largely personal experience for many consumers. However, some people will be looking for a virtual sales experience to maximize convenience, speed and ease of use. This will likely result in a more complicated, and potentially costly, set of consumer expectations for dealers to meet at a time when businesses are looking to recover and thrive in the wake of the pandemic.”

–Karen Bowman, vice chairman, Deloitte LLP and U.S. automotive sector leader

Category: Electric Vehicles, Equipment, Featured, General Update, Green, News, Products, Vehicles